Discover Top Techniques on a Forex Trading Forum to Optimize Your Gains

Discover Top Techniques on a Forex Trading Forum to Optimize Your Gains

Blog Article

The Relevance of Currency Exchange in Global Trade and Business

Money exchange serves as the backbone of worldwide profession and commerce, allowing seamless transactions in between diverse economic climates. As fluctuations in exchange rates can pose substantial threats, reliable money danger management becomes paramount for keeping an affordable edge.

Function of Currency Exchange

Money exchange plays an important role in assisting in global profession by making it possible for transactions in between parties running in different money. As businesses significantly participate in international markets, the demand for efficient money exchange mechanisms ends up being paramount. Currency exchange rate, which fluctuate based upon various financial indicators, figure out the worth of one currency family member to an additional, influencing profession dynamics considerably.

Furthermore, currency exchange mitigates threats connected with foreign transactions by offering hedging alternatives that safeguard versus damaging currency movements. This economic tool permits services to support their prices and incomes, further advertising worldwide profession. In summary, the role of money exchange is central to the performance of global commerce, providing the important framework for cross-border deals and sustaining economic growth worldwide.

Effect On Pricing Strategies

The mechanisms of currency exchange dramatically affect rates strategies for companies engaged in worldwide trade. When a domestic currency enhances against international currencies, imported products might become less expensive, allowing businesses to lower prices or boost market competitiveness.

Moreover, services need to think about the economic conditions of their target markets. Local getting power, rising cost of living rates, and currency stability can determine just how products are priced abroad. Firms often take on rates approaches such as localization, where costs are tailored to each market based upon money changes and local financial variables. Furthermore, dynamic pricing versions might be employed to reply to real-time money motions, making certain that businesses remain agile and competitive.

Impact on Revenue Margins

If the worth of that money reduces family member to the firm's home money, the earnings understood from sales can lessen significantly. Conversely, Learn More if the foreign money values, earnings margins can raise, boosting the general financial efficiency of the service.

Furthermore, services importing products deal with similar risks. A decrease in the worth of their home money can cause higher costs for foreign items, ultimately squeezing profit margins. This scenario requires efficient currency risk management approaches, such as hedging, to minimize prospective losses.

Firms need to remain attentive in keeping track of money trends and readjusting their financial methods accordingly to secure their lower line. In summary, understanding and taking care of the influence of currency exchange on profit margins is crucial for organizations making every effort to maintain profitability in the facility landscape of worldwide profession.

Market Accessibility and Competitiveness

Browsing the intricacies of global profession requires companies not just to manage revenue margins however additionally to guarantee efficient market accessibility and enhance competitiveness. Currency exchange plays an essential duty in this context, as it directly influences a business's capability to get in brand-new markets and compete on a global scale.

A positive currency exchange rate can decrease the More Bonuses cost of exporting goods, making products much more appealing to international consumers. On the other hand, an undesirable price can blow up rates, preventing market penetration. Companies must strategically handle currency changes to enhance prices methods and stay competitive against regional and worldwide players.

Furthermore, organizations that efficiently utilize currency exchange can create possibilities for diversity in markets with desirable problems. By developing a solid presence in multiple currencies, businesses can mitigate threats connected with dependence on a single market. forex trading forum. This multi-currency method not only improves competitiveness however also fosters strength when faced with economic shifts

Threats and Difficulties in Exchange

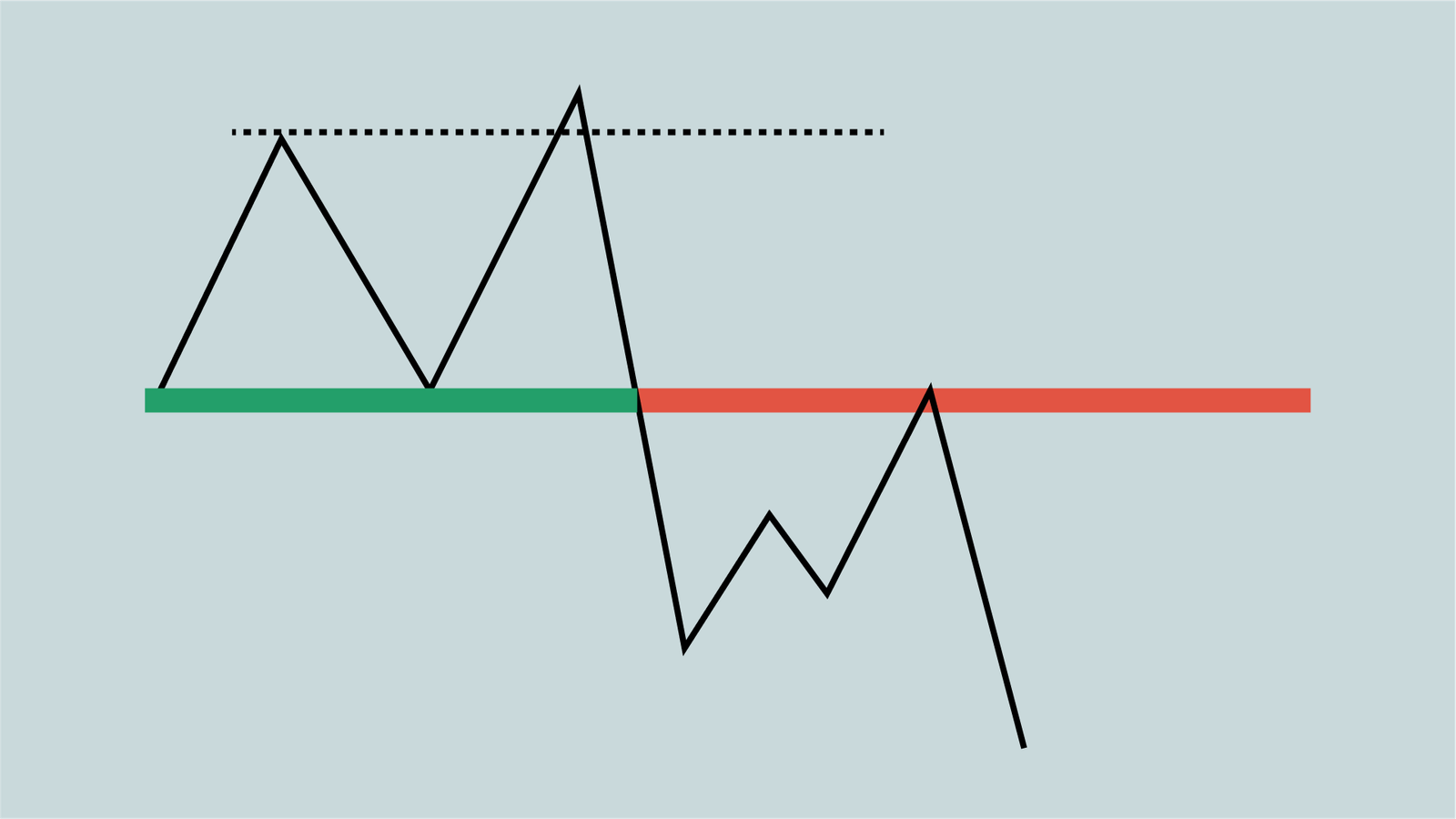

In the realm of worldwide trade, organizations deal with significant risks and obstacles associated with money exchange that can affect their monetary security and operational strategies. Among the main risks is currency exchange rate volatility, which can lead to unexpected losses when transforming currencies. Fluctuations in currency exchange rate can influence earnings margins, especially for companies involved in import and export activities.

Furthermore, geopolitical aspects, such as political instability and regulatory adjustments, can intensify money dangers. These elements might lead to abrupt shifts in currency worths, complicating economic forecasting and preparation. Additionally, organizations should browse the complexities of international exchange markets, which can be affected by macroeconomic signs and market view.

Conclusion

To conclude, money exchange acts as a keystone of international trade and commerce, helping with transactions and boosting market liquidity. Its impact on prices approaches and revenue content margins underscores the necessity for efficient currency risk management. Furthermore, the capacity to browse market accessibility and competition is critical for services running internationally. Despite integral dangers and challenges connected with fluctuating exchange prices, the importance of money exchange in promoting financial growth and strength continues to be obvious.

Report this page